Find out how you can offer your employees the Deutschlandticket as a job ticket and how you can combine the Deutschlandticket with a flexible mobility budget to provide your employees with all mobility options.

The Deutschlandticket is set to become more expensive and will cost 58 euros per month from next year. The transport ministers of the federal states agreed on an increase of nine euros from January 1, 2025. Here you can find all information on the Deutschlandticket price increase.

What does this mean for the Deutschlandticket as a job ticket?

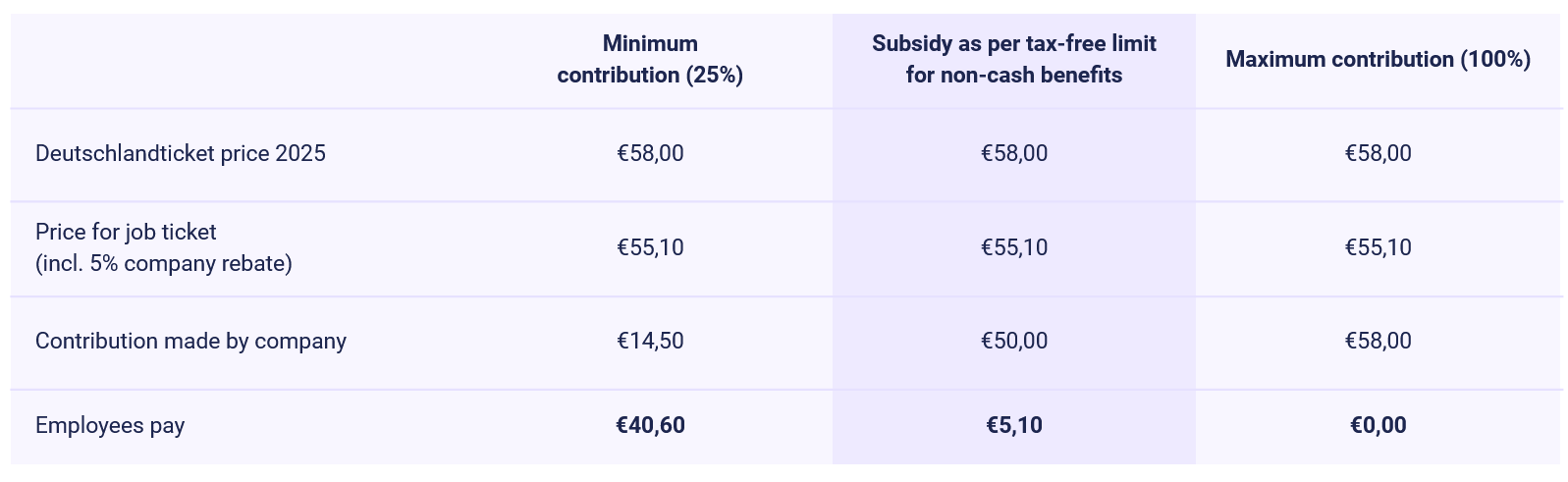

We are following the issue closely and are in constant contact with all relevant stakeholders. As a result of the price increase of the Deutschlandticket to 58 euros, the employer contribution will remain at 25 percent of the ticket price and will be increased from the current 12.25 euros to at least 14.5 euros from 2025. The five percent reduction granted by the federal government for these cases will be retained. This combination will increase the price to be paid by the employee (if the company only pays 25% of the ticket price) from the current 34.30 euros to 40.60 euros.

How much will the Deutschlandticket Job Ticket cost from 2025?

Following the price increase of the Deutschlandticket to 58 euros, the employer contribution will remain at 25% of the ticket price and will increase from the current 12.25 euros to at least 14.50 euros from 2025.

The five percent discount granted by the federal government for these cases will be retained. This combination will increase the price to be paid by employees (if the company only pays 25% of the ticket price) from the current 34.30 euros to 40.60 euros.

The price of 58 euros, which will apply from 2025, exceeds the 50-euro tax-free limit for benefits in kind. How can companies then offer the Deutschlandticket tax-free?

Employers can continue to offer the Deutschlandticket as a job ticket free of tax and social security contributions without non-cash benefits. This works via the regulation of §3 No. 15 EStG, according to which tickets for public transport can be offered tax-free by the employer and used by employees. NAVIT also offers a split-payment solution with which companies can subsidize the Deutschlandticket on a pro rata basis and thus remain below the 50 euro non-cash benefit exemption limit by passing on the amount exceeding 50 euros to the employees.

We have summarized the most important facts about the Deutschlandticket for you and explain how you can offer the 49-euro ticket as a job ticket for your employees. We also show you how to combine the Deutschlandticket with a flexible mobility budget to make your company stand out and give your employees maximum flexibility for their mobility.

The Deutschlandticket is the successor to the 9-euro ticket, which the German government introduced for three months in the summer of 2022 to ease the burden on people in the face of rising energy prices. With a total of around 52 million tickets sold, it was such a success that both the federal and state governments wanted to build on it.

On May 1, 2023, a new era began for local public transport in Germany. Thanks to a nationwide digital ticket, the confusing tariff structure of public transport - with its countless tariff zones, honeycombs or areas of the various transport associations - will be a thing of the past for many millions of people. Around 13 million people currently have a Deutschlandticket.

According to a new study by the Ariadne science network, the Deutschlandticket has already led to lower emissions in the transport sector: CO2 emissions from car traffic fell by around 6.7 million tons in the first year of the ticket, which was introduced in May 2023, corresponding to a 4.7 percent reduction in total transport emissions. This was announced by Ariadne on October 07, 2024.

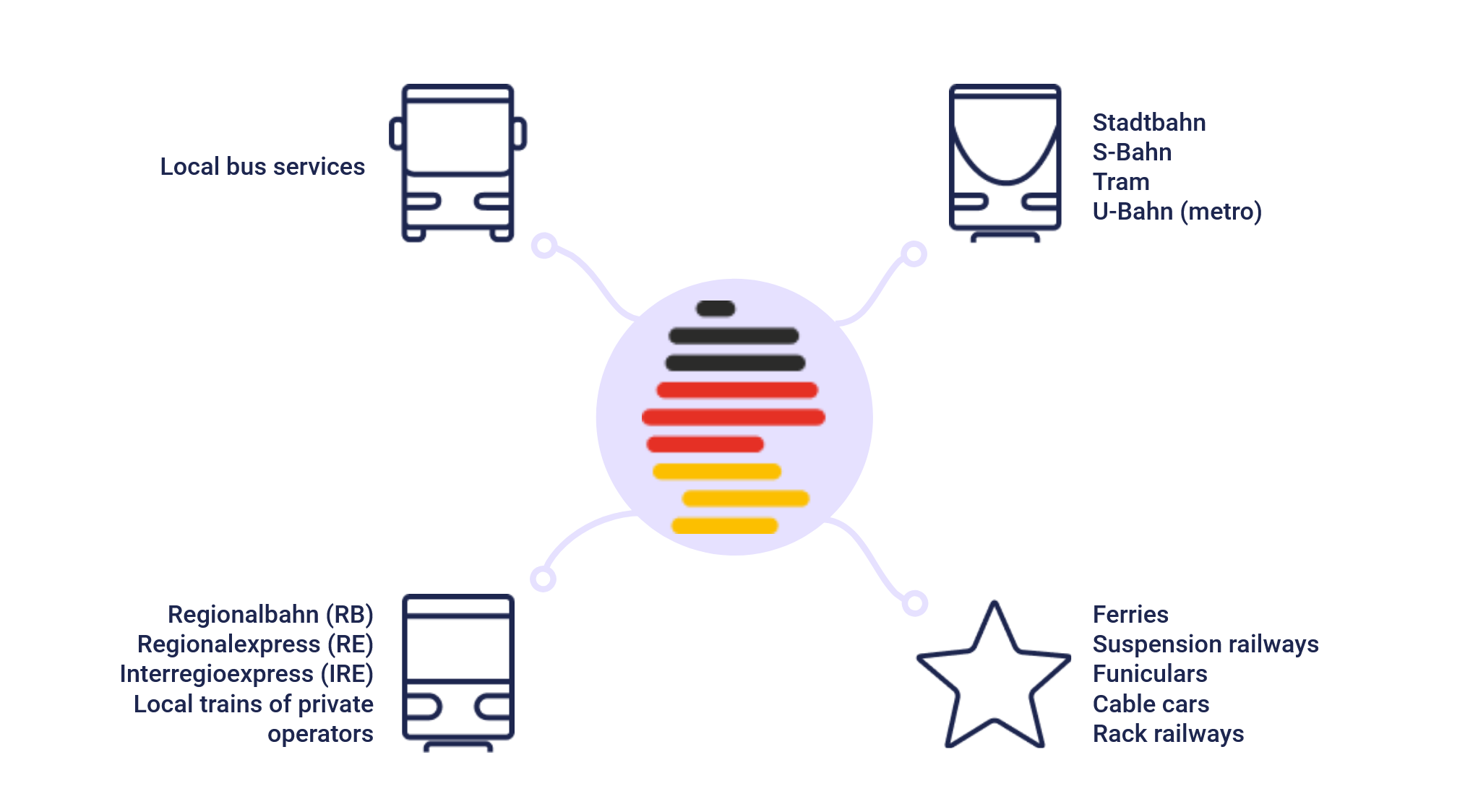

The Deutschlandticket is valid on all local public transport service since May 1st, 2023.

The Deutschlandticket has cost 49 euros per month since its introduction. According to the German government, a monthly price of 49 euros is still planned for 2024. However, the Deutschlandticket is to cost 58 euros per month from next year. The transport ministers of the federal states have agreed on 23 September 2024 on an increase of nine euros from January 1, 2025.

In principle, the federal states can decide for themselves at what price the Deutschlandticket is available. In some federal states and transport associations, there are therefore also discounts for certain groups of people such as pensioners, welfare recipients or students, which are not available nationwide with the Deutschlandticket. For example, students in some regions can upgrade their semester ticket to a Deutschlandticket by making an additional payment.

For more information on this, we recommend contacting your local transport authorities.

At a current price of 49 euros per month, the ticket is much cheaper than many other season tickets in major German cities. Also with the new ticket price of 58 Euro starting in 2025, the Deutschlandticket will be more affordable than most local monthly passes. In addition, it is not only valid within the respective transport association, but throughout Germany. This means that if you buy the Deutschlandticket from Hamburger Hochbahnen (HVV), for example, you can still use regional trains throughout Germany, as well as the streetcar in Munich or the subway in Berlin.

In principle, the federal states can decide for themselves at what price the Deutschlandticket is available. In some federal states and transport associations, there are therefore also discounts for certain groups of people such as pensioners, welfare recipients or students, which are not available nationwide with the Deutschlandticket. For example, students in some regions can upgrade their semester ticket to a Deutschlandticket by making an additional payment.

Please note the offers of the individual federal states. However, these offers only apply state-wide and not nationwide. Berlin, for example, introduced the 29-euro ticket on July 1, 2024. For more information, we recommend contacting your local transport association.

As a "flat rate for local public transport", the ticket is valid throughout Germany on all scheduled buses, streetcars, subway trains, suburban trains, and local and regional trains.

Which trains can be used with the Deutschlandticket:

However, the Deutschlandticket is not valid for long-distance travel. This means that the ticket is generally not valid for journeys on IC, EC, ICE or night trains, e.g. between Hamburg and Munich, with the exception of a few special regulations. However, it can be used on local transport in both cities. It is advisable to ask Deutsche Bahn about the special regulations. This is because some regional express lines are operated by DB-Fernverkehr. In some cases, IC trains are used on these sections, which means that the Deutschlandticket is valid on certain IC connections. The Deutschlandticket is also not valid on long-distance buses and private coaches, e.g. Flixbus.

In principle, the Deutschlandticket can be combined with long-distance travel. However, travelers must ensure that they buy a separate ticket for the long-distance route. In addition, the train connection is not canceled if you miss your connecting long-distance train. This means that it is not possible to use a later train free of charge with a ticket with a train connection (e.g. saver fares). In this case, train passengers cannot claim a refund.

In fact, the Deutschlandticket can also be used for journeys to these European countries. For example, the Deutschlandticket is valid for journeys to Austrian stations of Salzburg, Kufstein and the Swiss station of Schaffhausen (including the feeder lines), as well as on routes to France or the Netherlands, e.g. to Venlo.

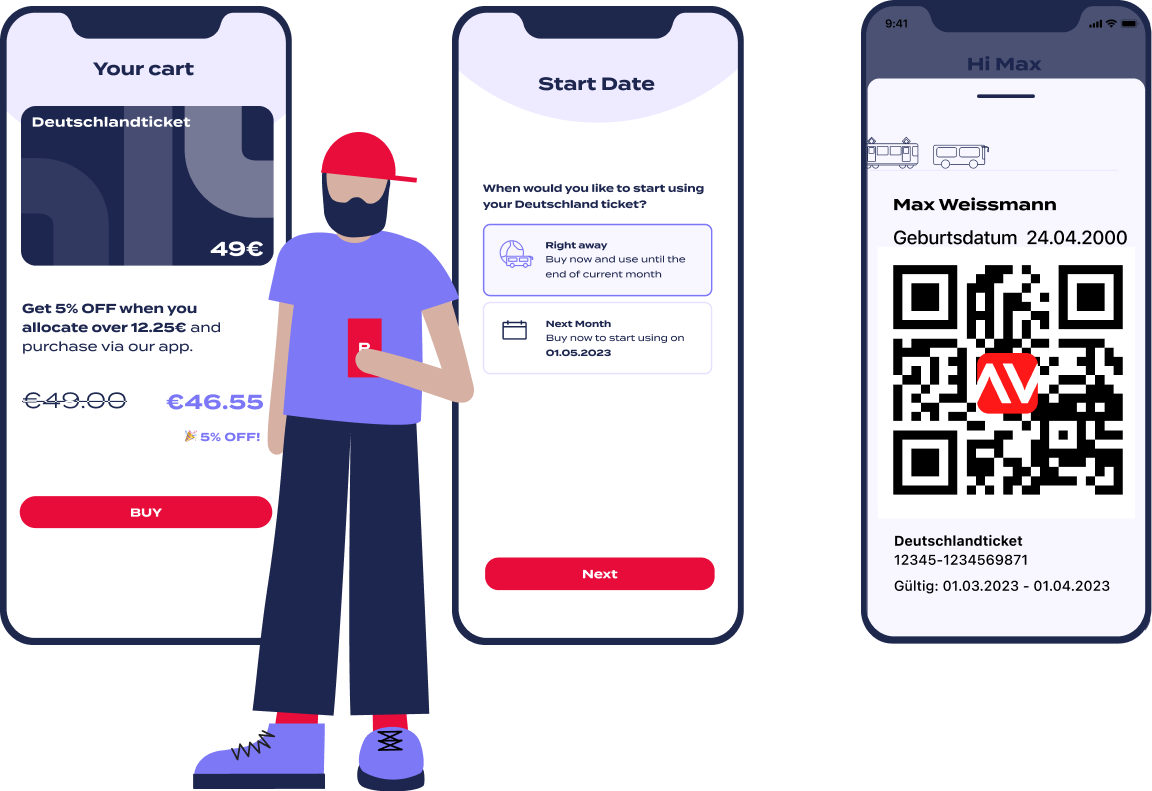

The Deutschlandticket is a digital ticket and can be ordered online. The ticket can be purchased through the sales channels of Deutsche Bahn as well as through the transport associations. Unlike the 9-Euro-Ticket, the Deutschlandticket does not have to be purchased every month, but can be conveniently taken out as an annual subscription and canceled monthly.

The Deutschlandticket is also available with NAVIT: With NAVIT, you can offer the Deutschlandticket Job to your employees quickly and without any additional administrative effort. NAVIT takes care of the application to the transport association, the administration of employee registrations and provides the ticket directly in the NAVIT app for employees.

Info: Register your company here now and enable your employees to receive the Deutschlandticket quickly and easily.

Create the work place of tomorrow with NAVIT. We are happy to support you with designing the best mobility solution for your company. Get in touch with us!

Contact us

What is a job ticket?

The job ticket, also known as company ticket or company subscription, is a special ticket for commuters who travel to work by bus and train. It was developed to make it easier to switch from company cars to public transport and thus relieve commuter traffic. The job ticket is attractive because employees can use it not only for commuting to work, but also for private journeys.

Job ticket one of the most popular employee benefits

For a long time, the job ticket was considered one of the most popular corporate benefits for companies that wanted to offer their employees a tax-free and cost-effective alternative to a company car. It also served as an expression of environmentally conscious employer behavior. However, the job ticket was associated with rigid minimum purchase quantities and complex contract negotiations with the transport associations.

In order to receive a Jobticket, rail commuters have to check whether their employer has concluded a Jobticket framework agreement with one of the participating transport companies. However, the introduction of the Deutschlandticket has opened up a more flexible and attractive solution for both company employee mobility and rail commuters. (Find out here: For whom the Deutschlandticket is still worthwhile)

In many German cities, commuters benefit from the 49-euro ticket, as it makes using public transport significantly cheaper than normal monthly or annual tickets from transport associations. In many cases, this can also apply to the job ticket. Employers and employees should contact the transport associations to find out about current rates and prices.

Although the job ticket model remains in place, the introduction of the Deutschlandticket Job has expanded the range of tickets on offer and simplified administration. The “Company Ticket Germany” enables employees to travel throughout Germany with a single ticket. Employers have the option of extending their existing job ticket agreement or introducing a new attractive job ticket for their employees. For companies, the Deutschlandticket will be even cheaper as a job ticket.

If employers already offer such a company ticket model as part of their employee benefits, they can decide whether to give their employees a choice between the two or only offer one of the two options. The costs that employers cover for employees can be deducted from tax as business expenses (Section 4 (4) EstG). This also includes the provision of a job ticket or company ticket.

If employers subsidize the Deutschlandticket by at least 25%, they receive a 5% discount from the federal and state governments or the transport associations. Employees save 30% of the costs and can use public transport throughout Germany.

There are various reasons for companies to introduce the job ticket. Employees also benefit from the Jobticket in various ways. In this article, we have summarized everything you need to know about the Jobticket and its advantages for companies and employees.

A clear comparison of when a job ticket or a Deutschlandticket is worthwhile for your company and your employees can be found here:

The prerequisite for a tax-free job ticket is that the employer grants it in addition to the salary. As described above, the employer can either provide or subsidize the Deutschlandticket job ticket for employees at a reduced rate with additional payment or free of charge. The subsidy is exempt from tax and social security contributions in accordance with Section 3 No. 15 EStG.

Employees can also use the ticket for private journeys in their free time. This is because, in the case of public transport travel entitlements, it is not checked whether employees have used the job ticket exclusively for journeys between home and their primary place of work.

The situation is different for long-distance passenger transport: Here, only journeys between home and the first place of work are eligible for tax relief. Exception: According to the BMF letter dated November 7, 2023, employer subsidies for local public transport tickets (e.g. Deutschlandticket or Jobticket) are tax-free if they can be used for certain long-distance train connections.

Employers should also bear in mind the 50 euro tax-free limit for benefits in kind (Sachbezug) in connection with the Deutschlandticket job ticket. If this has not yet been claimed in the month, it can be applied. If employers grant the Deutschlandticket as a result of a salary conversion, this remains tax-free within the 50 euro exemption limit.

Employers should keep the relevant evidence and document the non-cash benefit in the payroll account. Employer benefits for the job ticket must also be certified in the wage tax statement. This applies both if the job ticket is tax-free and if it is taxed at a flat rate.

Tax-free employer benefits such as a Deutschlandticket job ticket reduce the employee's income-related expenses deduction or commuting allowance accordingly. Employers should therefore also pay attention to the Germany ticket: If the allowances are higher than the actual costs, this surplus must generally be taxed as taxable wages.

The employer can reimburse the full cost of a Deutschlandticket for business trips or professional away-from-home activities as tax-free travel expenses in accordance with Section 3 No. 13 or No. 16 EStG if the cost of saved individual tickets for business trips equals or exceeds the price of the Deutschlandticket in the respective calendar month. The extent to which private journeys are made with the Deutschlandticket is not relevant.

Employers can also grant employees travel allowances. They can tax these at a flat rate of 15 percent. They would then forgo the tax exemption for job tickets. It is also possible to tax corresponding employer benefits at a flat rate of 25%, for example as part of deferred compensation.

If employers grant a Deutschlandticket job ticket as part of a salary conversion, this is generally taxable. The non-cash benefit is then subject to income tax. However, employers have the option of taxing the non-cash benefit at a flat rate (25 percent). In this case, the employee's commuting allowance is not reduced.

Our mobility experts at NAVIT would love to share their knowledge with you about the new mobility product. Feel free to get in touch with us!

Get infoThe Deutschlandticket Job ticket is a discounted offer of the Deutschlandticket especially for employees of companies, authorities and associations. Holders of the Deutschlandticket Job ticket benefit from a discounted monthly ticket from their employer, which allows unlimited use of public transport and local trains in Germany.

The federal government subsidizes the Deutschlandticket by 5 percent if employers pay at least 25 percent of the cost of the ticket for their employees. This means that employees only have to pay 34.30 euros instead of 49 euros (40.60 euros after the price increase to 58 euros starting January 2025) for the monthly Deutschlandticket Job ticket.

If the employer subsidizes the Deutschlandticket as a job ticket by at least 25 percent, the federal government subsidizes the job ticket for employees with a discount of 5 percent. This makes the Deutschlandticket Job ticket cheaper than the regular 49 Euro Deutschlandticket. It only costs employees 34.30 euros.

The Deutschlandticket Job ticket is a digital monthly ticket that gives employees unlimited access to regional and local public transport throughout Germany. As a “flat rate” for public transport, the ticket is valid throughout Germany on all buses, streetcars, subway trains, suburban trains, as well as local and regional trains. The Deutschlandticket Jobticket can be used not only for commuting to work, but also for private journeys.

No, travelers cannot take anyone else with them on a Deutschlandticket. Fellow travelers need their own ticket. In addition, ticket holders cannot transfer any travel arrangements from an existing season ticket to the Deutschlandticket.

As a rule, the Deutschlandticket Jobticket is worthwhile if the holder of the ticket regularly travels to work by public transport. We have summarized for whom else the Deutschlandticket is worthwhile in this article on the Deutschlandticket.

You can find all the information about the Deutschlandticket as a job ticket summarized in our clear factsheet for download here.

Sign up for our newsletter to receive the latest insights about our mobility solution products like the 49 eurojob ticket.